Are you losing sleep over your investments? Implementing a portfolio rebalancing strategy is an excellent way to give yourself some peace of mind (and a few more hours of shut-eye every night). In this article, we’ll outline three signs that indicate you should rebalance your portfolio, while keeping emotions out of the equation. we’ll also answer the question, “How often should you rebalance your portfolio?” and explore five tax-advantaged savings accounts so you can choose which options are the best fit for your unique wealth management strategy.

How often should you rebalance your portfolio?

You should typically rebalance your portfolio every quarter to every year. Whichever strategy you choose, rebalancing works most effectively when you set rules for yourself and stick to them. Consistency will help you rebalance at the right time.

However, these are three more specific signs to watch for that indicate you should rebalance:

1. When the market goes up or down.

You likely remember that the stock market took a nosedive when the COVID-19 pandemic hit. At Curio Wealth, our rebalancing strategy at that time involved encouraging our clients to use this opportunity to buy stocks at a lower price, not because we were trying to time the market, but because the equity portion of the portfolio went down and our rebalancing strategy suggested we buy. This effort took a strong stomach to implement. If you did not have cash to use to purchase equities, it required selling safer, fixed income (bonds) and buying riskier equities (stocks). The key in situations like this is to avoid slipping into panic mode and stick to your strategy.

You can decide to rebalance based on whether a specific asset class goes up or down by at least 5 to 20%. Setting these kinds of parameters holds you accountable to analytics rather than emotion. That being said, remember to contact your financial advisor any time you experience a major event in your life that could change your financial situation.

2. When you receive (or spend) a large sum of money.

If you suddenly come into extra money such as an inheritance or a large bonus, you can use these funds to rebalance your portfolio. This is often ideal as it will allow you to rebalance without having to sell stocks and recognize taxable gains. Similarly, if you need to take money out of your investments, this is also an opportunity for portfolio rebalancing.

3. When you experience a big life change.

Milestones in life like buying a home, having a child, or entering retirement often signal that it’s a good idea to rebalance your portfolio because your income, as well as your financial needs, may have changed.

Pro Tip: Even if your portfolio contains only stocks, you’ll still want to consider rebalancing it from time to time. A diversified portfolio should include various asset classes, such as large and small cap stocks. These asset classes perform differently, so you should occasionally adjust the amount of each within your portfolio. Returning to the example of the pandemic, large cap technology stocks performed well during this time, while small cap stocks didn’t fare as positively. We sold the higher performers and purchased the lower performers as part of our rebalancing strategy.

Why is portfolio rebalancing important?

The Greek philosopher Heraclitus said, “The only constant in life is change.” The same holds true for the stock market. As market conditions evolve, your investment portfolio will look different at various points in the year. Portfolio rebalancing is an excellent way to ensure your investment allocation remains within your risk tolerance level. This tactic also helps you sell high and buy low to maximize your wealth, and it can open up opportunities to invest in some of the wealth-preserving tax-advantaged accounts we’ll go over below.

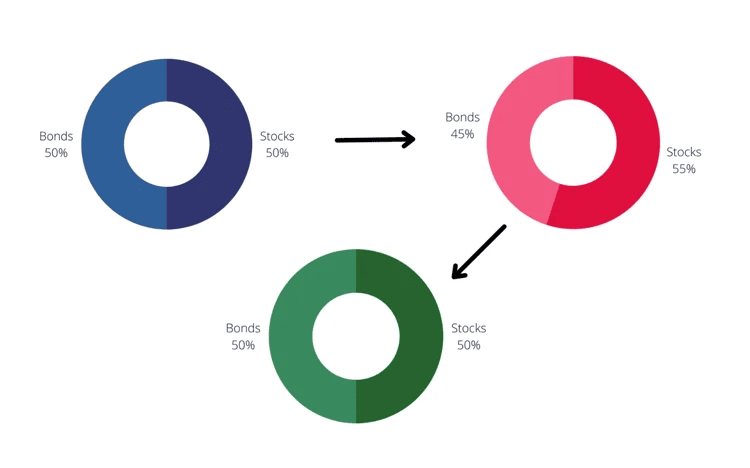

For example, if you invest 50% of your portfolio in the stock market and the other 50% in bonds, then stocks go up by 10%, your portfolio will be out of balance and no longer contain a 50/50 split. Instead, you’ll now have 55% exposure to the stock market, and your portfolio will be invested in a more aggressive manner than it was before.

In this case, if you had a rebalancing philosophy to follow, it would guide your next move: Seize the opportunity to sell 5% of your stocks at a high price, rebalance your portfolio (since you only need 50% invested in the stock market) and buy into safer assets to take some risk off the table.

5 Tax-Efficient Investment Accounts To Consider When Rebalancing

You always want to take taxes into consideration when rebalancing. it’s important to rebalance in a way that preserves your wealth but you know that’s easier said than done, especially when it comes to taxes. One way to save money that doesn’t require you to constantly track your expenses is by using tax-efficient investments.

A tax-efficient approach helps minimize the amount of tax you pay on your savings and investments, and it’s an integral part of your financial plan. The most important thing to remember about tax-efficient investments is that there are many options, and some may be more suited to your situation than others so be thoughtful about where you’re putting your money.

1. Employer-Matched 401(k)

Many employers provide this type of retirement plan, which enables you to contribute a portion of your pre- or post-tax income. Your employer will then match a certain amount of your contributions (the national average is slightly over 4%).

One significant benefit of a 401(k) plan is that you can invest a greater amount of your earnings into this account than you can put into an individual retirement account (IRA) or a Roth IRA, which we’ll explore below. People in the workforce under 50 years old may contribute up to $22,500 per year to their 401(k), while those over 50 may put an additional $6,500 into their account annually.

At minimum you should contribute the amount that is matched by your employer, it is free money!

2. Individual Retirement Account (IRA)

If your employer doesn’t offer a 401(k) plan, an IRA is one of the most tax efficient investment accounts you can choose. This type of account allows you to take a deduction for your contribution (as long as you meet certain income restrictions) and defer tax on the money you initially deposit.

Your IRA can hold stocks and bonds. it’s a great fit if your tax rate is likely to be higher when you fund the account than it will be when you make a withdrawal, which is when you’ll be taxed on your previous contributions. You must begin taking money out of your IRA when you reach age 73, but you can start as early as age 59 if you like.

3. Roth IRA

A Roth IRA is an account that enables your investments to grow tax-free. In contrast to a traditional IRA, you pay tax upfront when you invest in this type of account. You’ll realize the benefits of a Roth IRA later down the road when you want to withdraw your money, because you won’t pay tax on it at that time. This is especially helpful if you’re in a higher tax bracket when you withdraw the funds than you were when you opened the account. If you’re considering this type of account, keep in mind that Roth IRAs have various income limits.

4. Health Savings Account (HSA)

If you have a health insurance plan with a high deductible, you’re eligible to open an HSA. Individuals can put up to $3,850 into their HSA, while families can contribute up to $7,750 for 2023. The catch here is that the money must be used for medical expenses or Medicare premiums. The main benefit of an HSA is that any money you take out is tax-free.

| Pro tip: Many people invest in their HSA, let the wealth in the account grow until retirement, and use the money then to cover medical expenses and Medicare premiums (HSA accounts are generally not allowed to be used for health insurance premiums). You receive a tax deduction up front and the money comes out tax-free, to be used for medical expenses or Medicare premiums. Those 50 and older can contribute an additional $1,000. |

5. 529 Account

A 529 account is one of the most tax-efficient investments available if you’re planning to save up for your children’s education or transfer wealth to future generations.

Similar to a Roth IRA, this type of account grows tax-free. However, a 529 account doesn’t carry an annual contribution limit, though it’s recommended you follow the annual gift tax limits. In contrast, in 2023 a Roth IRA only allows you to put $6,500 into the account each year (or $7,500 if you’re over 50). If you’re saving for college, you’ll have a larger window to increase your wealth than if you’re saving for elementary or secondary school. 529 contributions are still owned by the Account Holder and can be accessed if needed. In addition, you can change beneficiaries if one (or more) of your children choose not to go to college, or receive a scholarship.

Rebalance Your Investments in Tax-Favored Accounts

it’s wise to choose several types of tax-efficient accounts to broaden your portfolio, sometimes known as tax-diversification, and as a best practice it may also be prudent to you to include different kinds of investments in each account. This strategy is often referred to as asset location. For example, it’s a good idea to keep regular bonds (which carry a higher interest rate) in your IRA to defer tax on those investments. On the other hand, in Roth IRAs and taxable accounts, it’s a good idea to invest in more stocks, ETFs, mutual funds, and possibly dividend-paying stocks to capture as much tax-free growth as possible.

| Pro Tip: In a taxable account, shoot for more growth because capital gains, when realized, are taxed at a lower rate than ordinary income. |

Asset location has an effect on rebalancing. During rebalancing, you’ll want to consider and adjust to the asset types in your portfolio. If, for example, your portfolio is in a taxable account, there are tax implications each time you rebalance: You’ll trigger capital gains when you sell and buy. Consider which types of investments are suited for which types of accounts, and which types of accounts call for certain rebalancing schedules.

Giving to charity is another way to diversify your portfolio and minimize the amount you owe on your tax return. For example, if you’re a business owner and you sell your company for $1 million then decide to give $100,000 to charity, you can take the entire charitable tax deduction in the year you sell the business, but you don’t have to choose where to donate the money until later. Using a donor-advised fund allows you to invest the money and choose the charity in the future.

Get Advice On Rebalancing With Taxes In Mind

Curio Wealth advisors go beyond buying and selling mutual funds. We try to find opportunities to help you save money and realize greater value from your investments. We can recommend the most tax-efficient investments for your personal financial situation, and advise you on the best time to rebalance and reevaluate.

If you’re interested in learning more about rebalancing or tax-efficient investments, schedule a free consultation call with one of our expert advisors today.